SMILE

THE ISSUE

After years of neglect, The Co-operative Bank needed to relaunch its subsidiary online banking brand Smile, and embrace Smile's original cutting edge aspirations and connection to younger audiences.

BACKGROUND

Smile was the first full-service internet bank in the UK, launched in 1999.

It was commercially successful in its heyday, won many financial service awards, and was ahead of the ethics and design curve by letting its customers determine its investments (no money invested in arm dealers or animal product testing).

However, during the financial crisis of ’08, Smile began to be neglected by The Co-operative bank and fell by the wayside. It stayed in operational limbo since the financial crisis and needs of an update.

While Smile is controlled by The Co-operative Bank it is its own brand (The Co-operative Bank is the parent brand). Smile customers would have to sign-up for The Co-operative Bank if they wanted an account at The Co-operative Bank, and Co-operative Bank customers would have to independently sign-up for Smile if they wanted an account with Smile.

HIGH LEVEL TIMELINE

3 weeks: brief to presentation

-Develop Tools (Co-design)

-Understand experience/market

-Empathize with users

-Secondary research

-Synthesize/Present

RESPONSIBILITIES

-Design co-design tool

-Lead concept development

-Interview stakeholders

-Find supporting research

-Build report

KEY GOAL

-Interview Gen Z/Millennials -Generate insights & strategy

OBJECTIVE

Research the Fintech market and interview Gen Z & Millennials to identify insights/opportunities for a relaunch strategy:

-How can we better connect with younger generations?

-How might we offer a better day to day bank experience?

Our objective was to understand the needs and desires of younger audiences and generate insights as to how Smile could develop a unique service/experience based on our findings; not to focus on the operational hygiene--Smile was aware of the many deficits the service was in need of optimizing to be attractive at a basic level.

TOOLS

A combination of user-centered design, design thinking, and co-design tools and skills to interview target audiences and develop insights.

INTERVIEWS

DESIGN THINKING TOOLS

- 4 Target User

- 2 Group Interviews

- 1 Financial Expert

- 3 Smile Employees

- 2 Current Smile Customers

- 1 Online Survey

- IDEO Download

- Dot Voting

- Clustering

- Brain Writing

- HMW

- Double Diamond

SECONDARY RESEARCH

- Desktop Research

- Analogous Experience

- Immersive Experience

CO-DESIGN TOOL

- Personification Exercise

USER-CENTERED DESIGN TOOLS

- Wallet Content Exercise

- Monthly Budget Exercise

- User Timeline Exercise

PROCESS

Focus on the first part of the Double Diamond by performing primary and secondary research, followed by synthesizing findings into three key insights and a final 'how might we' (HMW) to guide Smile's relaunch strategy.

Develop Tools: We implemented co-design in our interview process, as studies have shown that co-design allows stakeholders to provide unique value propositions that are more impactful than conventional user-center design research approaches.

Understand experience/market: Interviewed 3 Smile UX team members, and 2 existing Smile customers, to understand Smile’s current services, problems, and strategic direction. We also performed an immersive experience by signing up with a competitor brand.

Empathize with users: Conducted 4 in-depth interviews and 2 group interviews (4 people in each group) with target audiences to understand how audiences perceive banks now and what they would like from banks in the future.

Secondary research: Performed a financial expert interview and 1 online survey (33 participants) to follow up on co-design findings, and an analogous experience to build on the financial expert interview.

Synthesize/Present: Distilled information through design thinking methods/tools to identify 3 opportunities and a how might we (HMW).

MY ROLE /

CO-DESIGN

The team comprised of myself and three other international team members (Peru, Italy, and the UK), with backgrounds in finance, research, and graphic design.

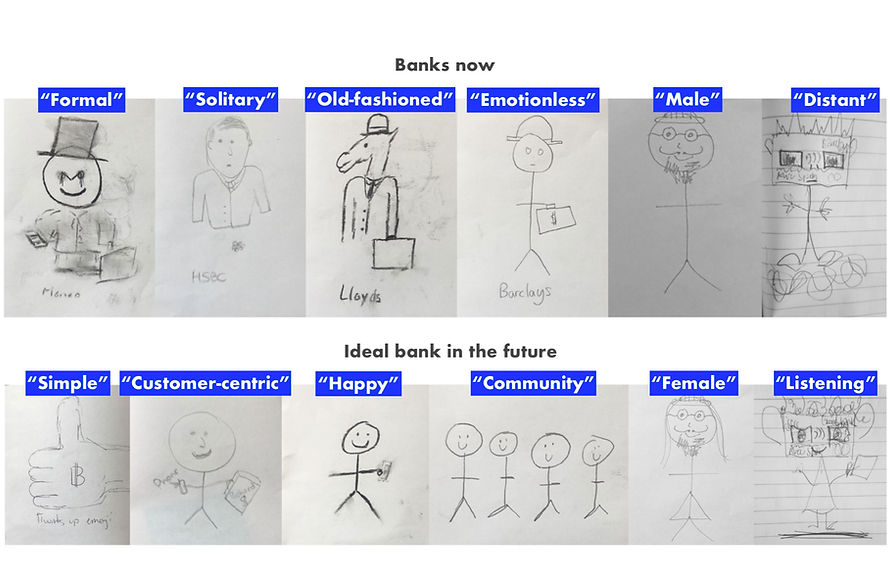

My main contribution was identifying emotional intelligence as a theme for the presentation, and the development of a co-design tool that asked stakeholders to draw a personification of their bank as they see them now, followed by drawing their ideal bank as a person in the future.

The co-design tool proved to be very useful, as it actively engaged interviewees in the research process and provided many of the main insights to the project.

The co-design exercise came about because brand experience and customer identity seemed to be more of our focus than user interaction (UI). Smile was well-aware of its deficits in UI; they needed more information regarding brand (‘how can we connect’) and service development (‘offer a better day to day banking experience’). By asking people to personify their banks, we could begin to reveal more of the brand identity they want to reflect (connect) and the processes and emotions behind it (experience).

To do this, Interviewees were asked to draw their bank as they see them now, as if it were a person. After finishing the drawing, they were asked to describe why they drew their banks the way they did to reveal their current views, and for them to start internally identifying what they might want to change.

Immediately after, they were asked to draw their ideal bank in the future, as a person. Again, after drawing, they were asked to describe why they drew the bank as they did to reveal deeper insights into their wants and needs from a bank.

(Samples of before and after drawings from interviews)

FRAME INSIGHTS

The final pitch to Smile was centered on the HMW above, which is intended to act as a North Star for Smile's branding and strategic direction.

To get to our HMW, we extracted insights from our research and synthesized them into three opportunities.

Building on the three opportunities identified, we interjected emotional intelligence (EQ) as a conceptual tool by tying each opportunity to an aspect of EQ measurement. EQ was explained to Smile as a focus because of its significance in innovation and business success.

What are measurements of EQ?

-Self-assessment

-Self-regulation

-Empathy and compassion

-Effective communication

-Relationship management

For the sake of the brief, we focused on the last three elements--empathy and compassion, effective communication, relationship management--which relate to the three opportunity areas we identified.

FINDINGS / OPPORTUNITIES

INSIGHT / OPPORTUNITY #1

During the personification, almost all participants first drew a man in a suit for their current bank (which looked like the Monopoly man) and then drew a woman / genderless persona for their future bank.

When talking about their personifications, participants explained they wanted a bank that cared for the community and listened to the customer (empathy).

A hypothesis of femininity being representative of empathy was developed and tested through an online survey asking for three attributes of femininity; the top two responses were empathy and strength.

To reinforce an abscence of femininity in current banking, our secondary research found the #SheBanking white paper, which cited a need for more feminine langauge and communication styles.

(Interviewee's future bank drawing)

(Monopoly Man)

When asked why participants first drew men in a suit and then a woman /genderless persona, most said it was a default, and associate masculinity with the narrative of 'traditional banking'; and all participants said they did not want a traditional bank. Participants went on to say they want a bank that cares for and listens to the customer and community (empathy). The findings do not imply that masculinity is terrible, and femininity is ideal; rather, there is an opportunity to incorporate more feminine qualities to reflect empathy.

To better understand what femininity means to people, and to support our hypothesis of femininity representing empathy, an Instagram survey on all four of the team's accounts asked: What are three attributes you associate with femininity? 33 people responded (25 women and 8 men); the top five attributes people identified all reflected elements of EQ:

-STRENGTH (13)

-EMPATHY (12) (EQ - Empathy & compassion)

-COMPASSION (4) (EQ - Empathy & compassion)

-CARING (4) (EQ - Relationship management)

-INTUITION (4)

To follow this up, we did secondary research and found the #SheBanking white paper. The paper identified women as feeling excluded and alienated from the current banking narrative and a need to develop services that reflect and incorporate feminine language and communication styles within banking services and organizations.

In short, women are a market overlooked in banking and a feminine style of language could help reflect the bank people want to see.

(Survey responses)

INSIGHT / OPPORTUNITY #2

In 1-1 interviews and group conversations people expressed it was important for banks to share information in a clear and understandable way; especially after the last financial crisis when banks developed the reputation for predatory lending.

This taught us customers want more than information, they want information in a way they can understand (which builds to the third insight).

In an interview we conducted with Smile, we learned that both Smile and the Co-operative bank view their ethical stance as a unique selling point and part of their 'original cutting-edge aspirations'. However, interviewees did not see ethics as a selling point--including the 2 current Smile customers--and cited transparency as being more pressing.

A recurrent observation in 1-1 and group conversations was people viewing banks as self-concerned vs customer-oriented, purposely using jargon to confuse, and untrustworthy.

We learned from both our financial expert interview and user interviews that people want to access and clearly understand information regarding investment portfolios and financial product obligations, in a clear manner. This is more than just giving the information to people, it is about giving them the language and tools to understand the information.

INSIGHT / OPPORTUNITY #3

(Smile's future vision)

People consider education around money and finance both important and lacking. However, they don’t want to be told what to do by banks, they want to be given tools to understand how to make their own decisions.

Through the co-design exercise, the Smile team reveled they see the future of Smile as a friendly and young service, with an emphasis on financial education. Learning about Smile's vision informed part of our research questions, which included understanding if younger audiences wanted education as a part of their banking experience.

Interviewees agreed that there is a general lack of education in society around money and finances, at all age levels. However, group discussion and interviews showed they did not consider financial institutions as impartial when giving advice on money or when teaching about financial awareness. Also, banks were sometimes perceived as teaching in a punitive way, instead of a preventive way.

People want tools which help them understand how to make financial decisions, not to be told what to do and disciplined if they don't do as told.

TITLE OF THE CALLOUT BLOCK

PERSONAL IDEAS / RECOMENDATIONS

-Use co-design at a larger level to start developing relationships with potential customers.

-Target families by developing tools for kids to learn about money management at an early age.

An example of how Smile could co-design at a large scale level is by being a sponsor at Manchester's Parklife Festival--which caters to a younger demographic. Smile could set up a water station and give out water bottles for free in exchange for a drawing or another co-design exercise which reveals the audience's thoughts and desires for an ideal bank. Performing an act as such would be an excellent way to build brand presence, trust (through a 'non-traditional' exchange system), and continue to co-design the bank their target audience wants.

Interviews also revealed people often didn't choose their first banks, and had a guardian or job sign them up initially and then stayed (and would later open other accounts because of a loan). By targeting families and the element of kids and teens, Smile could build and incorporate educational tools that teach children about money at an early stage. This strategy builds on the foresight of a more cashless society, which interviews and secondary research reflected--In ten years, it's foreseeable that kids will not be receiving cash from parents, and instead receive transfers into their accounts for weekly allowance and thus using banking cards. (We were unable to find enough young millennial parents within our network to substantially investigate this avenue at the time).

TITLE OF THE CALLOUT BLOCK

LESSONS LEARNED / REFLECTION

-Co-design was a powerful tool that brought unique and impactful insights and should be developed for the interview process when possible.

-UX and Brand should be thought of holistically.

-Interviewing the client like a customer was vital for insights into Smile's thinking and systems deficits; there was more to know than what the brief told. Had we not interviewed Smile, our findings would have been redundant for processes already being fixed, or been limited in impact because of internal bureaucracy.

Early research showed that Fintech services were of little difference to audiences, as they all relatively offered the same function with slight variations (it was a Coke or Pepsi situation; the difference is more taste and brand appeal). The choice of a bank often came down to word of mouth or because of elements of a brand (many people cited choosing Monzo because of the pink bank card). Brand didn't override UX, but they informed and complimented each other.

Target audiences were attracted to Fintech banks because of their 'non-traditional bank' status, cheap exchange rates (specific to a European audience), and quick signup processes (Monzo takes less than 5 minutes to signup, and your card arrives in 48 hours). All three of these aspects were difficult for Smile to overcome because of its ties to the Co-operative bank (a traditional bank) and its policies—and again, issues the Smile UX team already knew. Because the Co-operative banks controls Smile's processes, it is an internal struggle that was beyond our ability to solve.

While their were other avenues to investigate, we stayed focus on the results from the personification exercises (which were unique in findings compared to other groups at Hyper Island) and strategized Smile's UX at a higher level of brand development and business values. The only drawback of our proposal is its abstraction; how do you create an emotionally intelligent bank? Had time permitted, it would have been beneficial to develop some artifacts to illustrate what this would look like and how Smile should do it.